Enriched Food Market Size to Surpass USD 460.30 Billion by 2034 Amid Strong Contributions from India, U.S., and Europe

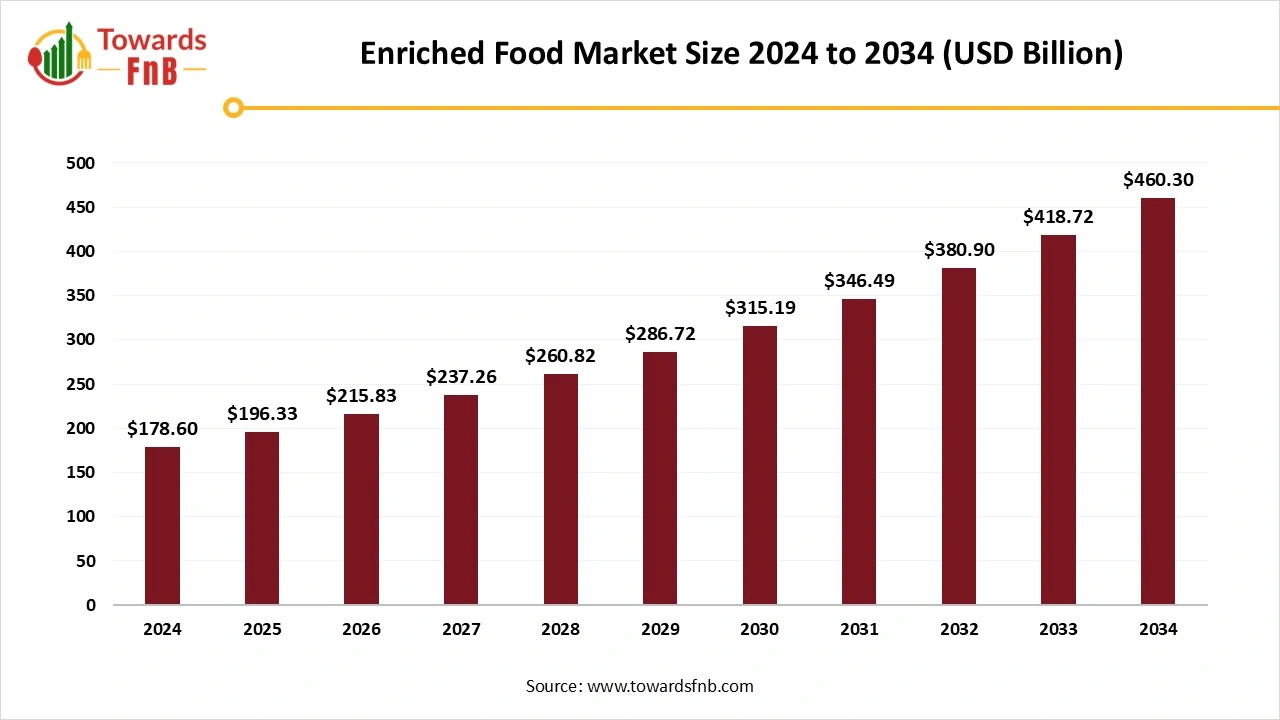

According to Towards FnB, the global enriched food market size is calculated at USD 196.33 billion in 2025 and projected to hit around USD 460.30 billion by 2034, growing at a healthy CAGR of 9.93% during the forecast period from 2025 to 2034. The enriched food market is experiencing a boom in recent periods due to high consumer demand for healthy eating and a healthy lifestyle, aiming to lower the chances of prevalent diseases associated with an unhealthy lifestyle.

Ottawa, Aug. 05, 2025 (GLOBE NEWSWIRE) -- The global enriched food market size stood at USD 178.60 billion in 2024 and is expected to increase from USD 196.33 billion in 2025 to around USD 460.30 billion by 2034, growing at a CAGR of 9.93% from 2025 to 2034, according to study published by Towards FnB, a sister firm of Precedence Research.

The enriched food market is experiencing a boom in recent periods due to high consumer demand for healthy eating and a healthy lifestyle, aiming to lower the chances of prevalent diseases associated with an unhealthy lifestyle.

Vidyesh Swar, Principal Consultant at Towards FnB, stated, 'We are seeing increased momentum in the enriched food category, as more consumers prioritize nutrient-rich options and governments support healthier dietary frameworks worldwide.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5742

What are Enriched Foods?

Enriched foods are food products that have had nutrients added back after being lost during processing, typically to restore their original nutritional value. This process commonly involves the addition of vitamins and minerals such as iron, folic acid, or B vitamins to refined grains or cereals, helping to address potential nutrient deficiencies in the population. The purpose of enrichment is to ensure that the final food product maintains or improves its nutritional quality, helping to prevent or reduce micronutrient deficiencies in the population. For example, iron and B vitamins (such as thiamine, riboflavin, niacin, and folic acid) are often added back to refined grains to replace what was lost during processing.

Market Overview

Consumers today are aware of the importance of good health and a well-balanced and nutritional diet for overall well-being. Hence, the enriched food market has been observing a boom in recent years globally. Consumers today are willing to pay more for nutritional and balanced food to maintain their overall health. Hence, today, physical markets as well as online platforms are filled with fortified food products enriched with nutrition to complete the essential requirements of health. Pregnant females, health-conscious consumers, Gen Z, and consumers with detailed knowledge about nutrition form a huge base for the market, allowing its growth in the foreseen period as well.

Key Highlights of Enriched Food Market

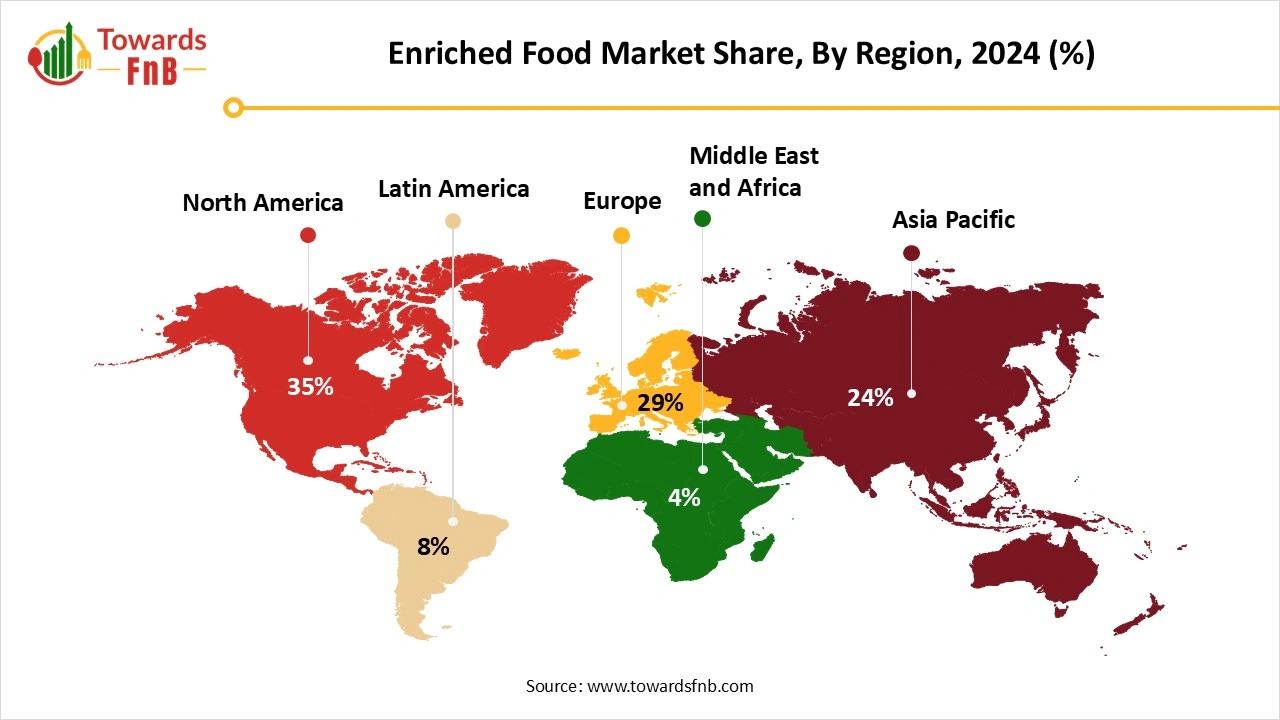

- By region, North America led the enriched food market in 2024 with highest market share of 35%, due to the presence of health-related issues on a larger scale, impacting the lifestyle of consumers.

- By region, the Asia Pacific is expected to grow in the foreseen period, with rising awareness about health issues and the growth of health-conscious consumers as well.

- By enrichment, the vitamins segment captured the maximum market share in 2024.

- By food application, the processed food segment dominated the enriched food market in 2024.

- By vehicle/product format, the cereals and bakery product segment led the enriched food market in 2024.

- By consumer age group, the adult segment registered the maximum market share in 2024.

- By distribution channel, the supermarkets and hypermarkets segment contributed the largest market share in 2024 due to the ease of shopping for consumers.

- By price tier, the mass market segment dominated the enriched food market in 2024.

What are the New Trends of the Enriched Food Market?

- The increasing prevalence of lifestyle-related diseases such as obesity, heart attacks, high blood pressure, high blood sugar, and high cholesterol compels consumers to follow a healthy lifestyle, leading to the growth of the enriched food market.

- An increasing number of health organizations and government initiatives to promote a nutrient-rich and healthy lifestyle also leads to the growth of the enriched food market.

- An increasing number of vegans and consumers following plant-based diets is also helping the growth of the market due to the high demand for clean-label products enriched with nutritious and healthy ingredients.

Role of AI in Enriched Food Market

Artificial Intelligence (AI) plays a pivotal role in driving innovation and efficiency within the enriched food market. By leveraging data analytics and machine learning, companies can develop personalized nutrition solutions, tailoring enriched food products to individual dietary needs and health goals. AI accelerates product development by predicting the effects of functional ingredients, enabling faster and more accurate formulation of nutrient-rich foods. In production, AI-powered sensors and computer vision ensure consistent quality and safety, while also helping manufacturers maintain strict nutritional standards.

-

For instance, some food companies use AI to assess consumer dietary gaps and develop fortified foods tailored for specific nutritional deficiencies.

Recent Developments in the Enriched Food Market

- In June 2025, Jindal Rice Mills launched a new consumer brand named ‘Nourifyme’ offering a range of fortified rice, fortified basmati rice, and fortified wheat flour. The main aim of the launch was the Punjab Government’s dedication to fortified food products. (Source- https://www.thehindubusinessline.com)

- In March 2025, British plant-based beverage brand ‘Plenish’ launched its enriched oat milk with essential nutrients and no added oils or additives. The brand also claims to be the UK’s only clean-label fortified oat milk producer. (Source- https://vegconomist.com)

View Full Market Intelligence@ https://www.towardsfnb.com/insights/enriched-food-market

Top 5 Countries in Enriched Food Market & Their Contributions:

| Country | Contribution in Enriched Food Industry |

| India | A surge in protein-rich products reflects shifting diets, consumers are moving from carb-heavy staples toward enriched snacks, dairy, and beverages. |

| United States | Consumer demand favors functional ingredients such as probiotics, plant proteins, adaptogens, and low-glycemic sweeteners. Brands emphasize “clean-label” claims and use AI tools (e.g., Instacart Smart Shop) to surface high-protein, low-sugar options. |

| Germany | Cultural caution around fortification exists—state-mandated enrichment is minimal, and public sentiment favors obtaining nutrients through natural foods, but voluntary enrichment in premium, clean-label, plant-based products is rising, especially in urban markets |

| Canada | The weight management and sports nutrition categories are expanding rapidly, meeting demand from consumers seeking healthier weight-control foods and performance-enhancing supplements. |

Case Study: Nourifyme Launch by Jindal Rice Mills – India’s Push Toward Fortified Staples

Project Overview:

In June 2025, Jindal Rice Mills, a leading player in India’s rice industry, launched a new fortified food brand called Nourifyme. The brand offers fortified basmati rice and fortified wheat flour (atta), two essential products widely consumed across India. This initiative is part of a broader effort to make fortified, nutrient-rich foods more accessible to the general population, particularly targeting lower- and middle-income groups.

Government Support

The launch event was held in Chandigarh, with Punjab’s Minister Tarunpreet Singh Sond attending and emphasizing the state’s commitment to addressing hidden hunger through the fortification of staple foods. This government-backed initiative supports India’s ongoing efforts to enhance public health through improved nutrition, aligning with the country's larger nutrition and food security strategies.

Relevance to the Enriched Food Market:

India is undergoing a shift in dietary preferences, moving away from traditional carb-heavy diets toward protein-rich and nutrient-enriched foods. The launch of Nourifyme aligns with this trend by offering fortified versions of common staples such as rice and wheat flour. This initiative reflects the growing demand for enriched foods across mass-market segments, beyond just urban or high-income groups, and highlights India’s role as a significant player in the global enriched food market.

Strategic Importance:

- Public-Private Collaboration: Nourifyme represents a successful collaboration between the private sector and government, promoting fortified food at scale.

- Affordable Nutrition: By offering fortified staples, Nourifyme aims to provide essential nutrients to a large population at an affordable price.

-

Market Growth: The initiative supports India’s expanding role in the global enriched food market, where there is a rising demand for affordable and nutritious food options.

Market Dynamics

What are the Growth Drivers of the Enriched Food Market?

Multiple health-improving attributes help in the growth of the enriched food market. Prevalence of lifestyle-related diseases such as obesity, heart attacks, cardiovascular issues, cholesterol, diabetes, and mental issues helps the growth of the market due to the high demand for getting rid of such health issues. Consumers today are aware of the benefits of a healthy lifestyle and the role of nutritious food in it; hence, people are ready to pay more for such food products enriched with nutrition and essential vitamins and minerals for the body. Hence, such instances strongly help the growth of the enriched food market.

Challenge

Increased Prices of Fortification Restraining Market’s Growth

Increased prices of fortification of food products are one of the major restrictions on the growth of the enriched food market. Lack of uniform regulations globally for food fortification is another restraining factor in the market’s growth. The presence of artificial flavors, additives, and various other chemicals during the manufacturing of food products leads to issues in gaining consumers’ trust and maintaining it as well. Hence, such adulteration issues in the food manufacturing industries lead to restrictions in the growth of the market.

Opportunity

Technological Advancements are helping the Growth of the Market

Technological advancements helping to enhance the nutritional levels of fortified food products are helping the growth of the enriched food market in the foreseeable future. The technology helps to enhance the nutritional levels of food products during the fortification process without interfering with the food’s taste, texture, and quality. Nutrient stability and bioavailability help to maintain the enrichment of food products and allow consumers to gain benefits from such food products, helping the growth of the market.

Additionally, institutional nutrition programs, such as school lunch initiatives and public health-driven food subsidies, are contributing to enriched food demand in regions focusing on reducing malnutrition and nutrient deficiencies.

Enriched Food Market Regional Analysis

Which Region Dominated the Enriched Food Market in 2024?

North America dominated the enriched food market in 2024 due to multiple factors, helping the growth of the market in the region. Consumer awareness regarding the growing importance of a nutritional diet and overall health is one of the biggest factors of growth in the market. Prevalence of lifestyle-related disorders such as obesity, diabetes, high blood pressure, and cardiovascular issues also helps in the growth of the market. The conscious attitude of consumers leading to high demand for fortified and functional foods is also helping the growth of the market.

Which Region is Observed to Grow at the Fastest Ratre During the Forecast Period

Asia Pacific is expected to grow in the foreseen period due to high demand for fortified and functional food products by adults and children. It helps in their overall well-being and cognitive development. Rising disposable income and improving standard of living are also aiding the market by allowing consumers to spend more on premium and fortified products. Countries like India, China, Japan, and South Korea have a major share in the growth of the market in the Asia Pacific. The rising population of health-conscious consumers due to the prevalence of lifestyle-related diseases is one of the major factors in the growth of the market.

Enriched Food Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 9.93% |

| Market Size in 2024 | USD 178.60 Billion |

| Market Size in 2025 | USD 196.33 Billion |

| Market Size by 2034 | USD 460.30 Billion |

| Dominated Region | North America |

| Fastest Growing Region | Asia Pacific |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Enriched Food Market Segmental Analysis

Enrichment Analysis

The vitamins segment dominated the enriched food market as it is essential for the well-being and growth of an individual. Hence, the segment dominated the market in 2024. Fortified and functional food products are enriched with vitamins to complete the vitamin requirements of an individual. Lean meats, cereals, wholegrains, vegetables, fruits, and other similar food products help to fulfill the essential vitamin requirements of an individual. They help to strengthen the bones, improve immunity, balance hormones, and help in the quick wound healing of an individual.

The other fortifying micronutrients segment is expected to grow in the foreseen period due to the increasing prevalence of diseases in recent times. Micronutrients such as Vitamin B6, B12, D, E, calcium, folic acid, and various other essential nutrients are essential for overall well-being. Hence, the segment is observed to grow in the foreseen period.

Food Application Analysis

The processed food segment dominated the enriched food market in 2024 due to high demand for ready-to-eat and ready-to-prepare food products in the recent period. Such foods aid in the changing and hectic lifestyles of consumers these days, to avoid preparing a full-fledged meal after an exhausting day. Such foods are rich in taste, texture, and appeal, and hence are highly demanded by consumers. Hence, the segment dominated the enriched food market in 2024, especially with a huge consumer base consisting of Gen Z and working professionals.

The basic foods segment is expected to grow in the foreseen period as they are enriched with essential nutrients and are healthy for maintaining overall health and ensuring growth in infants and children. The segment consists of staples like cereals, dairy products, infant foods, and other similar food products.

Vehicle/Product Format Analysis

The cereals of the bakery product segment dominated the enriched food market in 2024 due to high demand for bakery products such as cakes, pastries, muffins, biscuits, and cookies. Such products, when made from fortified ingredients, are high in demand by consumers to complete their nutritional requirements, along with taste. When prepared from plant-based and vegan ingredients, the segment also gains a consumer base from vegans and plant-based diet followers.

The dairy/dairy alternative segment is expected to grow in the foreseeable period due to its importance for humans to complete their daily nutritional requirements. Vegans and plant-based diet followers form a huge consumer base for the dairy alternative market, as they prefer products such as almond milk and other relatable products free from dairy. Hence, the segment is observed to grow in the foreseen period.

Consumer Age Group Analysis

The adult segment dominated the enriched food market in 2024 due to the rising population of adults and the importance of a well-balanced and nutritional diet. High prevalence of lifestyle-related diseases such as obesity, blood pressure issues, diabetes, and stress also leads adults to follow a nutritional and well-balanced diet consisting of fortified and functional foods to fulfill the nutritional requirements of the body. Hence, the adult segment dominated the enriched food market.

The children or infants segment is expected to grow in the foreseen period due to the high demand for nutritious and fortified foods by children for the development of their cognitive abilities and overall body development. Such foods are enriched with essential nutrients, vitamins, and minerals. Hence, the segment is expected to grow in the forecast period.

Distribution Channel Analysis

The hypermarkets/supermarkets segment led the enriched food market in 2024 due to its convenience factor, helping the growth of the market. The availability of multiple fortified and functional foods under one roof helps consumers to buy the desired products easily. Hence, the segment dominated the market in 2024. Such food products are essential for overall health, and consumers are willing to pay more for them as well. Hence, the segment led the enriched food market.

The e-commerce segment is expected to grow in the foreseeable future due to the growth of various online and e-commerce platforms. Such platforms allow consumers to purchase different types of fortified and nutritional food products from the convenience of sitting at home without visiting any physical store. Hence, the segment is observed to grow in the expected timeframe. Such platforms also allow consumers to have a look at various other relatable products and get discounts and offers available for economical shopping.

Price Tier Analysis

The mass market segment dominated the enriched food market in 2024 due to rapid urbanization, growth of a conscious population, and high demand for fortified and functional foods by consumers of different age groups. Availability of low-cost functional and fortified foods in supermarkets and online platforms also helped the growth of the enriched food market in 2024.

The premium/organic fortified food segment is expected to grow in the foreseeable period due to high demand for organic products for their premium experience and high nutritional value. Rising disposable income of consumers allows them to pay high prices for such types of food products. Hence, the segment is observed to grow in the forecast period.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Fast Food Digital Transformation Market: The global fast food digital transformation market size is positioned for rapid expansion, with projected revenue growth over the next decade.

- Food Ingredients Market: The global food ingredients market size is projected to expand from USD 368.70 billion in 2025 to USD 567.09 billion by 2034, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034.

- Automation in Food Warehousing Market: The global automation in food warehousing market size is projected to expand from USD 4.58 billion in 2025 to USD 11.91 billion by 2034, growing at a CAGR of 11.2% during the forecast period from 2025 to 2034.

- U.S. Pet Food Market: The U.S. pet food market size is projected to witness strong growth from USD 45.39 billion in 2025 to USD 66.88 billion by 2034, reflecting a CAGR of 4.4% over the forecast period from 2025 to 2034.

- Specialty Food Ingredients Market: The global specialty food ingredients market size is projected to witness strong growth from USD 113.01 billion in 2025 to USD 179.87 billion by 2034, reflecting a CAGR of 5.3% over the forecast period from 2025 to 2034.

- Food Premix Market: The global food premix market size is projected to expand from USD 8.21 billion in 2025 to USD 15.48 billion by 2034, growing at a CAGR of 7.3% during the forecast period from 2025 to 2034.

- Infant Formula Foods Market: The global infant formula foods market size is projected to rise from USD 100.45 billion in 2025 to USD 240.75 billion by 2034, growing at a CAGR of 10.2% during the forecast period from 2025 to 2034.

- Private Label Food and Beverages Market: The global private label food and beverages market size is projected to witness strong growth from USD 255.90 billion in 2025 to USD 393.60 billion by 2034, reflecting a CAGR of 4.9% over the forecast period from 2025 to 2034.

Enriched Food Market Top Companies

- Nestle S.A.

- BASF SE

- General Mills, Inc.

- Tata Chemicals Limited

- Mondelez International, Inc.

- Cargill Incorporated.

- Danone

- Buhler AG

- Bunge Limited

- Unilever PLC

- Koninklijke DSM NV

- Stern-Wywiol Gruppe GmbH & Co. KG

- Arla Foods amba

- Nutritional Holdings (Pty) Limited

- Dr. Paul Lohmann GmbH KG Chemische Fabrik

- Wright Enrichment Inc.

- Gastaldi Hermanos S.A.I.C.F. E I.

- Sinokrot Global Group

- Ufuk Kimya Ilac Sanayi Ve Ticaret Limited Sirketi

- Corbion NV

Segments Covered in the Report

By Enrichment Type

- Vitamins

- Minerals

- Other Fortifying Micronutrients

By Food Application

- Processed Foods (e.g., snacks, ready-to-eat meals)

- Basic Foods (e.g., staples like flour, milk)

By Vehicle/Product Format

- Cereals & Bakery Products

- Dairy & Dairy Alternatives

- Beverages

- Infant Nutrition

- Snacks & Bars

- Other Enriched Foods

By Consumer Age Group

- Children & Infants

- Adults

- Seniors

By Distribution Channel

- Supermarkets / Hypermarkets

- Convenience / Traditional Stores

- E-commerce

- Direct-to-Consumer / Specialty Stores

By Price Tier

- Mass Market (Value)

- Premium / Organic Fortified Products

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/price/5742

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies |

For Latest Update Follow Us: https://www.linkedin.com/company/towards-food-and-beverages

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.